Understanding Market Cycles

10/15/2015

Market cycles represent fluctuations in stock, bond and investment markets. These cycles are closely tied with large-scale economic business cycles and have an important impact on investment, financial, cash flow and personal planning.

Market Cycles Versus Business Cycles

Market cycles and business cycles may sound the same, and are indeed very similar, but are slightly different. A market cycle typically refers to different phases in the stock market, whereas the business cycle is an underlying fundamental change in economic business activity as measured by real Gross Domestic Product (GDP) percent change (an important measure of the level of business activity in the economy), unemployment rates, manufacturing data and more.

The difference can be more clearly seen in the terminology; market cycles are defined by bull and bear markets, while business cycles are defined by economic growth and recession. A typical definition for bear market is a downturn of at least 20 percent over longer than a two-month period in either the S&P 500 for Dow Jones Industrial Average (DJIA). This is not to be confused with a correction, which is a short-term downtrend in stock markets. The length of market cycles also is important to note. If market analysts believe that stock appreciation will be a short-term trend, then it is referred to as cyclical. Long-term trends longer than a few months in duration are referred to as secular.

Business Cycle Stages

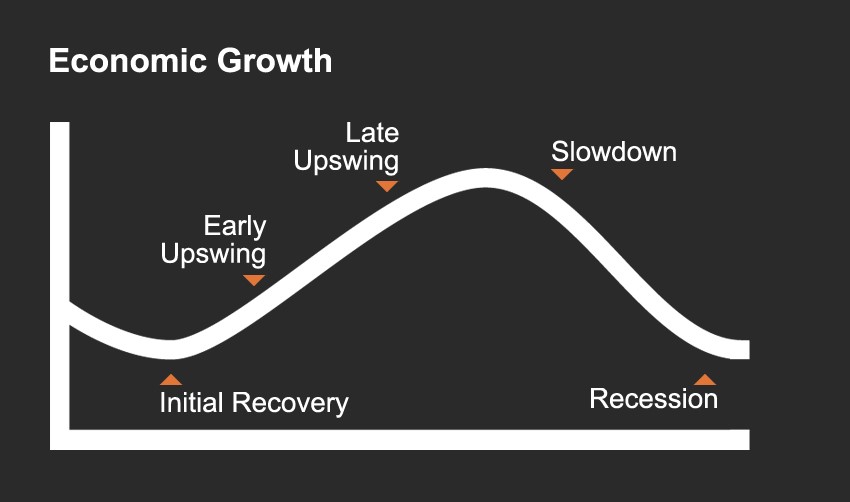

Not all phases of the business cycle can be easily separated, and the stages of the business cycle may only be able to be identified in retrospect. Still, it is useful to define the five stages to business cycles, as follows:

- Initial recovery: usually a short period in which the economy comes out of a recession. Unemployment remains high and consumer confidence will most likely be suppressed. At this point in the business cycle, open market activities to reduce interest rates or governmental policies, such as stimulus efforts, are enacted.

- Early upswing: confidence recovers and the economy gains some momentum. This is a very healthy period in time, where productive capacity is still able to keep pace with growing demand and there is no sign of significantly higher inflation.

- Late upswing: although confidence is high and unemployment is low, inflation is starting to pick up and offsets nominal economic growth.

- Slowdown: as a result of rising interest rates, the economy starts to slow. Investors reduce risk and shift stock allocations to bonds. Although there is a slowdown in activity, inflation is still likely to rise during a slowdown.

- Recession: typically defined as two consecutive quarterly declines in GDP; consumer spending contracts. Once the recession is confirmed, central banks start to cautiously increase the supply of money to spur growth. Recessions may be highlighted by bankruptcies, fraud or a financial crisis.

Although forecasting upcoming business cycles is particularly challenging, it helps to know how these cycles tie into market cycles and, ultimately, the performance of your investment portfolio. Historically, significant changes in U.S. real GDP usually follow the trend in the overall stock market (as measured by the S&P 500). This is because changes in the stock market reflect the forward-looking investing decisions made by market participants. Therefore, it is hardly useful in basing investment decisions on past economic data or economic forecasts.

Market and Business Cycle Effects on Investment Portfolios

While it is true that changes in GDP do follow changes in the stock market, the two are not more closely connected due to the difficulty associated with making accurate forecasts and because of the fact that investors are always trying to implement their investment strategy ahead of changing trends. Another factor that affects stock market activity is when deviations from forecasts occur. For instance, if the forecast for U.S. GDP for next year declines from 9 percent to 7 percent, the market is likely to react very negatively, despite the relatively strong economic growth associated with a forecast of 7 percent.

The effect of market cycles on investment portfolios is largely psychological, as significant swings in investment values can lead to doubt about investment decisions. The best way to deal with volatile markets is to adequately plan for cash flow needs ahead of time to make sure that those needs can be met even if stocks enter a bear market. Market cycles should not be a driving factor in making investment decisions. Those decisions should be driven by a focus on long-term investment and cash flow planning as well as asset allocation, which has been shown to be the main factor that drives investment returns.

How can I use my knowledge about market cycles to manage my investment portfolio?

- Timing the market will work sometimes, and others it will not. But attempting to time market cycles will almost assuredly result in a higher tax burden (short-term capital gains instead of long term) and higher transaction costs. Unless you have substantial time to devote to forecasting market cycles and trading activities, attempting to time market swings generally leads to negative results.

- While market cycles can be lengthy and emotionally draining, a long-term investment outlook is optimal to withstand the volatility that will be inevitably present in the market.

- Knowledge about the volatility of business and market cycles is a good reminder for those that are in or near retirement that do not have a long-term investment outlook or do not have the wherewithal to withstand volatility in the stock market to weight your portfolio toward more stable asset classes.

- All market cycles are different. It can be convenient to look back at a chart of the stock market during the last recession and assume that similar trading patterns will occur. However, this is rarely the case.