Commentary – 2023 2nd Quarter

4/14/2023

“I am a most unhappy man. Unwittingly, I have ruined my country. A great industrial nation is now controlled by its system of credit.”

- S. President Woodrow Wilson, 10 years after signing the Federal Reserve Act of 1913

A Slow-Rolling Crisis

The first quarter of 2023 was good for bonds and even better for the stock market. The S&P 500 was up 7.5%, the Nasdaq was up 17.1%, and the Bloomberg US Aggregate bond index was up 3.0%. The more growth-oriented and riskier parts of the market did best, with growth companies out-performing value.

The economy seems to be humming along despite consensus expectations of a recession this year. The job market is showing no signs of weakness. Manufacturing has turned down, but the much larger services part of the economy is still going strong. Economic growth, measured by GDP, is estimated to be approximately 2% in the first quarter.

With all this good news, it begs the question: why is the consensus still that a recession is just around the corner? And, if that is the case, why did the market start the year with a “risk-on” rally?

Dr. David Kelly, Chief Global Economist at J.P. Morgan, perhaps put it best, “this is like when there are sunny skies in the morning with thunderstorms forecast at night.”

The clouds started rolling in as two banks failed in March (Silicon Valley Bank and Signature Bank of New York), causing a flight to safety in high quality U.S. Treasuries and blue-chip stocks. Interestingly, the mega-cap technology stocks acted more like defensive stocks, as investors piled into shares. Microsoft and Apple, for example, contributed more to the S&P 500 index in the first quarter than all the financial sector stocks subtracted[1]. The eight largest companies in the S&P 500 (all technology companies) had a positive 5.55% return in the first quarter, while the “other 492” companies posted a 1% loss[2].

While Silicon Valley Bank was the largest lender to fail since the 2008-2009 crisis, it was comparably small considering the size of the behemoths such as Chase and Wells Fargo. While the Federal Reserve and U.S. Treasury admitted these banks were not “Too Big to Fail,” a very clear message was sent that no bank is “Too Small to Care.” Ultimately, regulators made all deposits whole, regardless of whether they ran afoul of FDIC insurance limits—which some 90% of Silicon Valley Bank’s deposits did indeed.

These interventions were the sort which would be expected in a crisis. They have fundamentally reshaped America’s financial architecture. Yet, at first glance, the problem appears to be poor risk management at a single bank. Peter Conti-Brown, a financial historian at the University of Pennsylvania, summed up our reaction to this news best, “either this was an indefensible overreaction, or there is much more rot in the American banking system than those of us on the outside of confidential supervisory information can even know.”

Simultaneously, the Federal Reserve is continuing its campaign to snuff out inflation with higher interest rates. These rate hikes, along with tighter credit, will impact banks already hindered by higher capital costs and deposit outflows. Suffice it to say that America is far from solving the problems in its small and mid-size banks. That means the economy could yet face a slower-burning crisis instead.

The issue is that banks are sitting on massive losses, at least on paper, due to the violent increase in interest rates over the past year. The financial markets are tranquil mainly because the federal government is backstopping the system. From The Economist –

“As of March 15th, banks other than the biggest 25 institutions had lost $141 billion of deposits this year and banks with nearly $4 trillion in combined assets have unrealized losses worth more than half of their core equity safety cushions. For smaller banks, losses on commercial-property loans could wipe out still more of the buffer.

By March 22nd, the Federal Reserve had lent $164 billion via facilities that issue loans worth more than the securities posted as collateral. According to Barclays, the Federal Home Loan Banks, lenders with an implicit government backstop, may have advanced $300 billion to banks in a single week.”

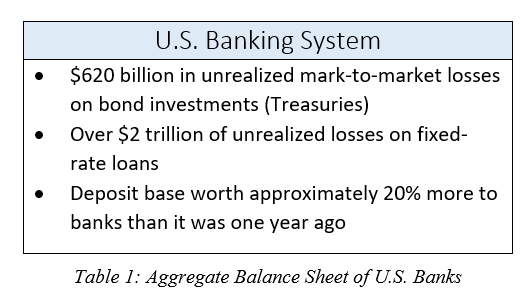

A recent academic study of the U.S. banking system from the University of Southern California found that the problems run deep (see: Table 1). In aggregate, a 10% hit to bond portfolios would wipe out more than a quarter of banks’ equity. Further, an analysis of the drop in value of fixed rate loans would be enough to wipe out all the equity in the entire banking system[3]. The financial system might have been well-capitalized a year ago, so the argument goes, but a chunk of this capitalization has evaporated.

Higher rates have also brought good news to banks. Customer deposits are worth much more to the banking system today, simply because they are the inverse of loans.

In other words, deposit flight is the real risk to the banking system. Paper losses only become real losses if they are crystallized. This was certainly the issue for SVB and SBNY. For this reason, the Fed and the Treasury have strongly hinted that they will bail out uninsured depositors should other banks fail. The Federal Deposit Insurance Corporation (FDIC) has also promised to set out options for expanding its guarantees by May 1st.

So far, these measures have apparently succeeded. But the propping up of banks with unrealized losses brings fresh problems of its own. Colloquially known as “zombie banks,” institutions keeping capital tied up in unproductive legacy assets was a problem that last struck America in the 1980s, plagued Japan in the 1990s, and troubled Europe in the early 2010s.

These banks could restore their capital ratios by lending less, or they may put off recognizing losses that may yet materialize on their loan books. For example, First Citizens Bank is now buying $72 billion of SVB’s loans at more than a 20% discount, suggesting that it foresees defaults ahead. The consequences of ignoring losses can be severe: in Japan it contributed to a “lost decade” of economic growth.

Avoiding this would require that policymakers refresh their stress testing of banks. Institutions both large and small will need to work out what would happen to their capital cushions if interest rates rose further, and if deposits were to be withdrawn. Banks that look too risky should be made to recapitalize by suspending dividends and discouraged from trying to improve their capital ratios by lending less.

A crucial test will be whether the Fed closes its emergency facility as planned in March 2024. If it is extended, and if Congress expands deposit insurance without trying to fix the underlying problems in the banks, then zombies could proliferate.

A Long Road Ahead

The Fed’s rate hikes will likely affect company fundamentals and economic output later this year. Higher rates mean higher costs for those who have borrowed, and the companies that borrowed most are facing the greatest difficulties. For example, office real estate is being squeezed by higher interest rates on one side and lower occupancy since Covid-19 on the other.

In addition, leading economic indicators are showing signs that there is weakening on a macro level. The red-hot labor market cooled some in March, with hiring moderating and wage growth easing as more Americans sought work. Sectors that boomed earlier in the pandemic, such as construction, manufacturing, and retail, lost jobs last month.

Luckily, there is no indication that a crisis a la 2008-2009 will recur now. Food and energy inflation are all but behind us. By all measures, the housing sector does not appear overextended. Labor Department data has shown that the number of workers filing for unemployment benefits has risen but is still near 2019 levels[4]. This is a sign the labor market remains solid despite large companies announcing layoffs.

The current odds-on bet is that the U.S. is headed back to an economy of slow growth, low inflation, and low (but not zero) interest rates.

However, getting to the outcome of a slow growth economy may not be easy. We are expecting a bumpy path going forward with the onslaught of geopolitical events and the exposure of debt-burdened companies. The fickleness of market participants digesting both of those worries, along with interest rate movements, will impact short term prices.

The market is hopeful, and currently pricing in, interest rate decreases later in 2023. While we believe the Federal Reserve will stop increasing rates after their next meeting, our current outlook is that rate cuts are further out—possibly not until early-to-mid 2024.

Here’s our case: if inflation continues to moderate, which all signs point towards, then the headline figure should decrease substantially with the May and June readings (reported in June and July). Inflation is reported as a rolling 12-month percentage and the May and June readings in 2022 were among the most aggressive. This suggests that the Consumer Price Index will clock in somewhere in the mid 3% range within the next 2-3 months (see: Figure 1)[5].

Amidst the backdrop of banking system issues and weakening economic data, we believe this will prompt the Fed to stop hiking rates after their planned 0.25% increase in May.

Amidst the backdrop of banking system issues and weakening economic data, we believe this will prompt the Fed to stop hiking rates after their planned 0.25% increase in May.

The case for a rate cut, however, is not as solid. Softer inflation data during the summer of 2022 is likely to prompt moderation, if not increases back up later in 2023. Further, the Federal Reserve has communicated that a strong labor market (high wage growth and low unemployment) will continue to weigh into their decision-making, along with asset price inflation (i.e., stock market runs).

Therefore, our expectation is a “hawkish hold,” where interest rates are kept at an elevated level, albeit not increasing, until the Fed is confident that the inflation problem is firmly in the rearview mirror.

While an imminent U.S. recession is still the consensus viewpoint, all signs are pointing to a mild one mostly led by a corporate earnings recession. The probability of a severe recession, typically accompanied by more aggressive interest rate cuts, is currently less likely.

This can of course change, or be amplified, by the ongoing Russia-Ukraine conflict and escalating tensions between China and the western world over Taiwan. The impact of these conditions on the market are both, of course, almost impossible to predict.

What is easier to predict is the idea that a slow-rolling U.S. banking crisis will lead to a long road ahead for the economy. As BlackRock CEO Larry Fink put it, “this is a price we will be paying for quite some time for the decades of cheap money.”

When the windshield is foggy and it’s difficult to see more than 10 feet in front of you, we believe it is helpful to take a longer-term view of the road ahead.

Dating back to 1950, a portfolio invested in 50% stocks and 50% bonds, represented by the S&P 500 and the Barclay’s Aggregate Bond Index, has never lost money over any given five-year period within the last 72 years[6].

We hope you enjoyed our comments. If you have any questions, please do not hesitate to contact us. We welcome the opportunity to discuss our thoughts in greater detail. Thank you for your continued confidence in Planning Capital.

Sincerely,

The Planning Capital Team

Author

Daniel B. Brady, MBA, CFP® │ Partner

Contributors

Richard W. Bell, Jr., CKA® │ Partner

David A. Emery, MBA, CDFA®, CFP® │ Senior Financial Planner

Jay D. Ahlbeck, CLU®, ChFC® │ Senior Financial Planner

Paul C. McClatchy, MBA, CFP® │ Senior Financial Planner

[1] Hardika Singh, “S&P 500’s Resilience Largely Thanks to Tech,” The Wall Street Journal, April 3, 2023

[2] “FAANG + MNT Stocks Impact on S&P 500,” Bianco Research, April 1, 2023

[3] “The Prop-Up Job,” The Economist, March 18, 2023

[4] Gabriel Rubin, “Supplier Prices Fell in March, Moderating Inflation,” The Wall Street Journal, April 13, 2023

[5] Thomas Balis, “CPI File 2023,” Cornerstone Portfolio Research, April 5, 2023

[6] “Guide to the Markets,” JP Morgan Asset Management, March 31, 2023

Want a chance to discuss this month’s Quarterly Commentary with Rick Bell and Dan Brady? Join us for the next Quarterly Conversation, our regular live webinar series on Zoom. The next one is coming up on April 20 at 4 pm. RSVP at the link.