Commentary – 2024 1st Quarter

1/10/2024

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”

- Winston Churchill

Technically, a “Santa Claus rally” refers only to the time between Christmas and New Year’s, but he was working overtime in 2023, as both stock and bond markets rallied for the entire month of December. Inflation is continuing to show signs of easing, which helped the Federal Reserve “pivot” to a more dovish stance, acknowledging that rate cuts are likely in 2024. The bond market quickly reacted and became even more dovish, predicting six rate cuts in 2024 compared to the three currently forecasted by the Central Bank. The US consumer remains key to the future of markets and the Fed’s actions and, for now, the American shopper appears relatively healthy. Employment remains solid and although household debt has increased, it appears to remain manageable.

The flipping of the calendar doesn’t necessarily mean market performance will change abruptly. However, there are some cautionary signs suggesting there may be some bumps in the road. Congress comes back to work and funding for two military conflicts and the entire US budget needs to get done by the end of January. Depending on how negotiations develop, bond vigilantes could express displeasure at the never-ending growth in spending. Additionally, earnings season will take center stage and full-year 2024 outlooks will be updated. With 12% annualized growth expected in S&P 500 earnings, any substantial disappointment would be met with selling pressure. Finally, as mentioned, the Fed appears to be at a pivot point, which historically signals that a spike in unemployment is on the horizon[1].

These issues are merely risks that could put a temporary pin prick in the modest bubble that has developed over the past couple months, but we don’t see anything that will push the bullish train off the tracks (at least for now). Election years also tend to be a boon for markets. Therefore, we are expressing cautious optimism for 2024, but acknowledge that the current expansionary cycle has been in extra innings for quite a while and a true economic recession has yet to occur.

Déjà vu All Over Again?

The stock market opened the year a whisker away from an all-time high. The S&P 500 has soared over the past 12 months, up by around 25%, with a handful of technology giants leading the charge. This should sound familiar, as these facts describe both January 3, 2022, and January 2, 2024. In 2022, the mood on the first trading day of the year was approaching euphoria. After the boom of 2021, the stock market appeared to be signaling that it was ready to continue its charge.

This, of course, did not pan out as the S&P 500 proceeded to drop around 20% in 2022. And so far, the high-water mark set in the first week of January 2022 remains intact. In contrast to the start of 2022, the tone at the beginning of 2024 has become anxious. In fact, a record $5.6 trillion is in money markets, as many investors see little value in the market beyond cash.

This is understandable, as stocks jumped by 16% in the final two months of 2023, representing two-thirds of the gain for the entire year. The S&P 500 rose for nine consecutive weeks, its longest winning streak since 2004. Having dipped in and out of a true “bull market” (a rise of at least 20% above the most recent low) throughout 2023, equities now are approximately 31% above that level. Financial markets often overshoot, and a lengthy hot streak is a sign that such an overshot may have occurred.

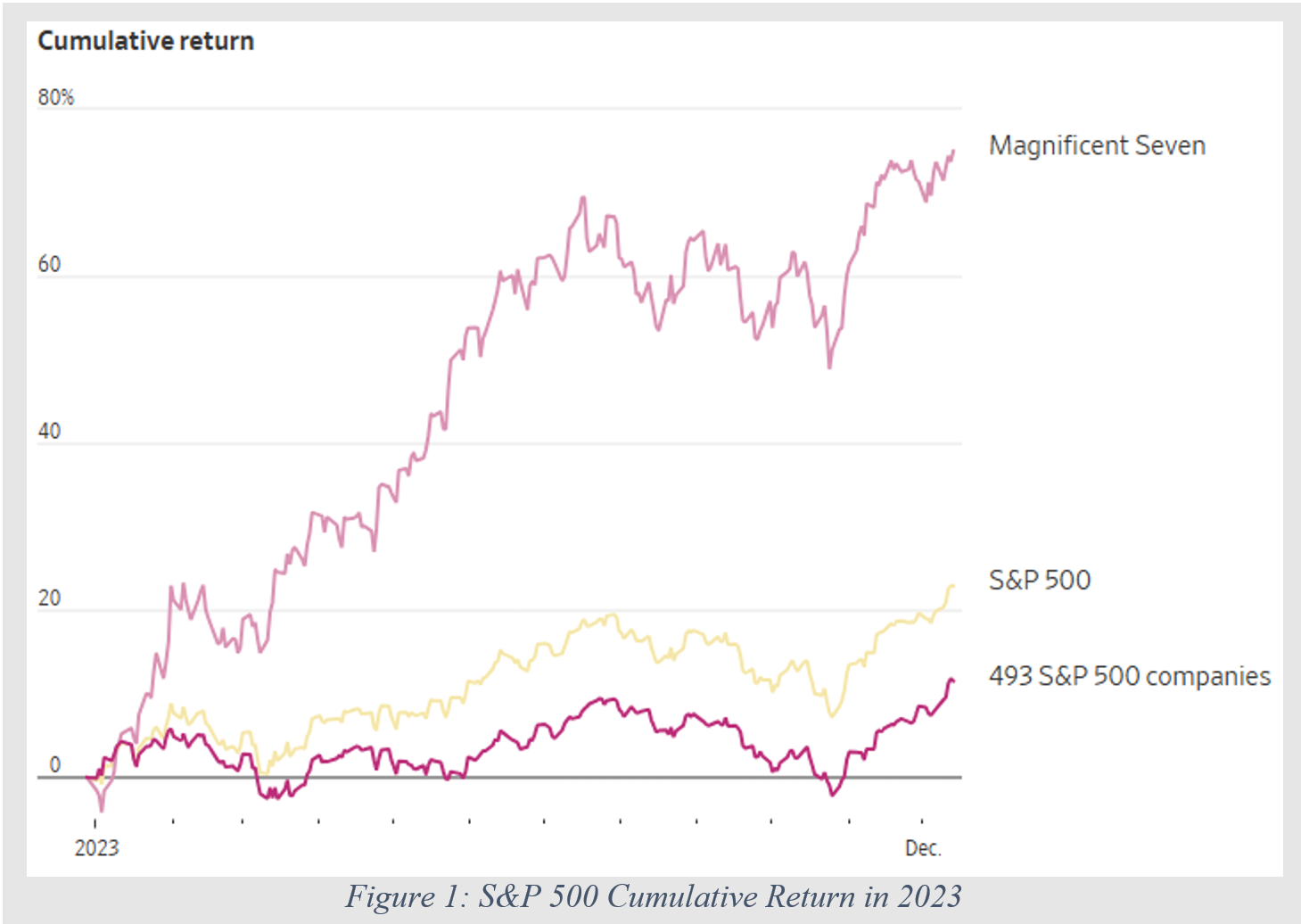

But the overall picture is not that of a market gripped by irrational exuberance. The so-called “Magnificent 7” (the 7 largest companies by market capitalization) increased approximately 75% in 2023 while the remaining 493 woefully underperformed (See: Figure 1).

It is important to consider the definition of “the market” in the age of passive index investing, especially after such a wide dispersion in returns. The top 7 stocks (Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla, and Meta) now comprise over 30% of the S&P 500[2].

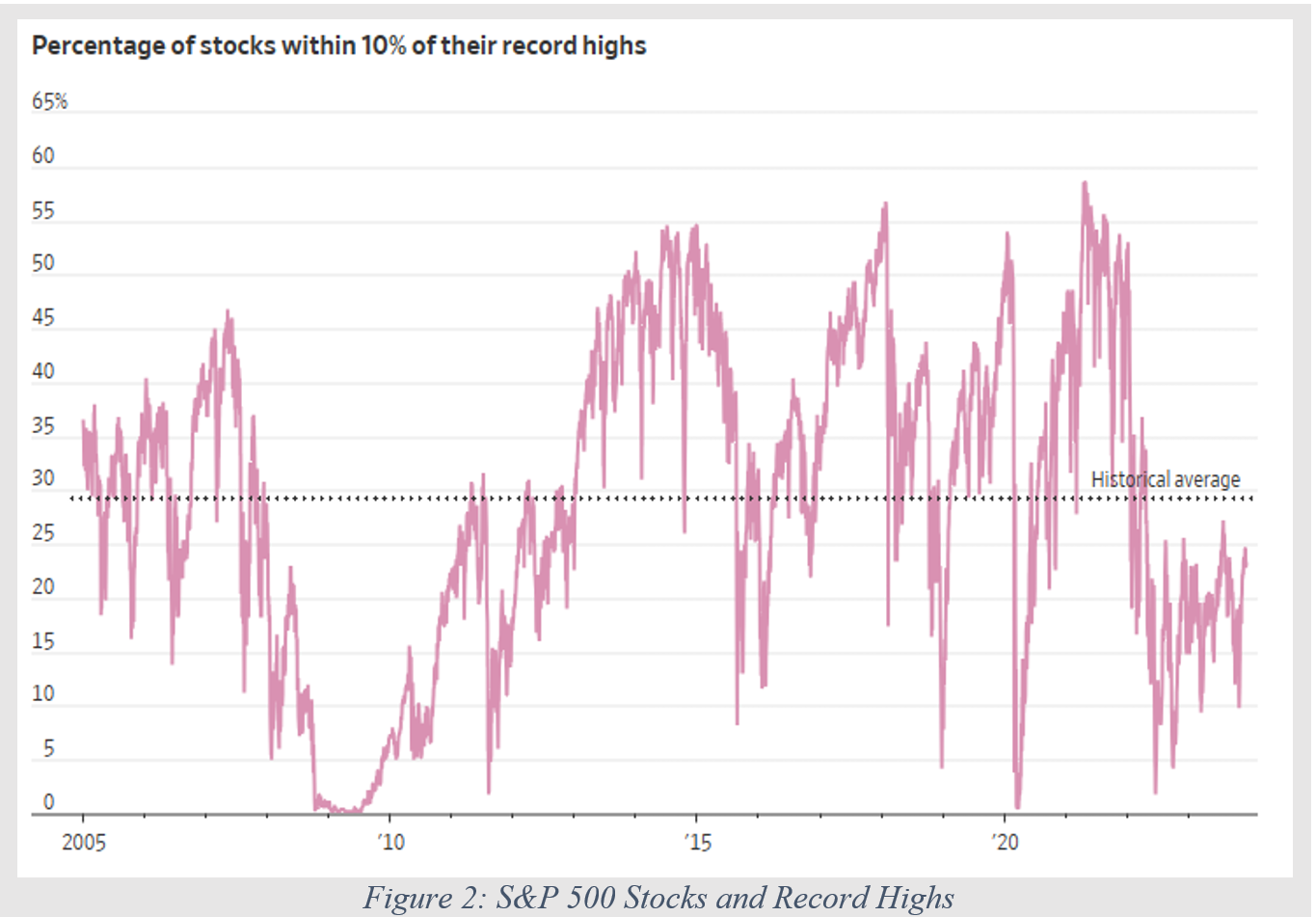

Since the remaining 493 have not kept pace, only 23% of the stocks in the index are within 10% of their record highs. That is well below the historical average (See: Figure 2).

Therefore, the broader opportunity set of “the market” still has ample room to run from a price perspective. At the same time, earnings growth projections are being revised upward as most analysts have become more optimistic on the heels of positive economic data.

Couple this underlying economic strength with the broad-based undervaluation, and 2024 has the potential for the market to break into the next secular bull trend. This would not be atypical, according to Ned Davis Research[3] –

“If the S&P 500 hits a new all-time high in 2024, expect a strong year of gains to follow. When the S&P 500 hits at least one record high in a given year, the year’s median return is about 15%. The data point highlights two typical characteristics of the stock market: that strength begets more strength, and that stocks don’t typically crash from all-time highs. To keep it simple, the takeaway is this: stocks hitting record highs is bullish, not bearish.”

The most obvious risk to the bull market is if any of the rosy economic indicators become gloomier in 2024. The combination of falling rates, slow inflation, and steady growth is Utopian for investors. Were strong growth to continue for too long, though, the Fed might be slower to cut rates than they hope. With less relentlessly upbeat news, it would only be natural for the market to give up some of its gains.

It is important to realize that even if stocks were to give up some of their gains, we would expect this to be less of a broad-based downturn and more of a tech-led downturn. But that of course depends on how you define “the market.”

The Other Magnificent 7

In keeping with the theme of the “Magnificent 7,” we are going to boil down the 2024 outlook into the seven economic and investment themes that we believe are the most important to your portfolio.

- The debate between “soft landing” and recession.

Easing inflation and improved prospects for growth have helped fuel optimism that a recession will be avoided (a “soft landing”). However, a quick look across each sector of the economy shows that economic momentum in the year ahead is set to be moderate, at best.

On a positive note, tailwinds from AI spending as well as federal government support for semi-conductor manufacturing should persist in 2024. The housing market also appears to have stabilized, as tight supply is offsetting higher mortgage rates.

However, increased caution among lenders and slowing corporate profits could still constrain growth in capital expenditures. In addition, government spending growth should slow as gridlock in Washington limits further stimulus.

Which means that a “soft landing” hinges on the American Consumer, who has thus far been supported by a tight labor market and wages. That said, there are some signs of weakness. Revolving credit as a share of disposable income does not look overextended, but delinquencies are rising, and younger households are showing signs of increased financial stress. As labor market conditions continue to loosen and lending standards remain tight, consumer spending should grow at a slower pace from here.

Overall, a slower-moving economy will be increasingly sensitive to shocks. Whether it be the U.S. election, higher policy rates, significant geopolitical tension, or something else entirely, risks remain that could push the economy into recession in 2024. It is important to remember that the U.S. economy has never come out of a tightening cycle without a subsequent recession[4].

- The unemployment rate should remain low until we see a recession.

After a red-hot labor market sent wages higher and brought unemployment down from a pandemic peak of 14.7% to a 50-year low of 3.4%, the labor market is now getting back to normal. Unemployment has hovered between 3.4% and 4.0% since December 2021.

While still above its long-term average, wage pressures are receding with businesses reeling back hiring efforts in the face of slowing consumer demand. Overall, a combination of subdued job growth and slowing wages should give the Federal Reserve further confidence that inflation is under control.

- Sustainable earnings will differentiate winners and losers.

Resilience in the U.S. economy has also been shared by Corporate America with earnings growth surpassing expectations in 2023, as consumer strength allowed companies to boost sales. But at the same time, higher input and labor costs detracted.

Looking to 2024 and 2025, expectations for double-digit earnings growth seem too optimistic as defending profit margins will become increasingly difficult in an environment of slowing economic growth and waning pricing power. However, high-quality companies with strong balance sheets, ample cash balances and sustainable earnings should perform well relative to the broader index.

- Inflation is trending towards the Fed’s target but has plateaued.

After inflation reached 50-year highs at 9.1% in June 2022, it has eased to 3.1% as of November 2023. While still above the Fed’s target of 2%, the underlying components of inflation provide confidence that the problem is under control for now.

Core goods prices trended lower in 2023 as supply chain distortions related to the pandemic and Russia’s invasion of Ukraine continued to fade. Also, shelter (housing) inflation has finally dissipated. The remaining problem is “transportation services,” including auto insurance and auto repair costs, which the Fed has identified when referencing persistent inflation.

Even if we see a further decrease, it appears that inflation is settling in at an above-target rate. Whether or not the Federal Reserve is content to live with this remains to be seen. Meanwhile, energy and food price inflation are almost non-existent in the most recent reading, creating what we believe to be a longer-term trend of upside inflation risks[5].

- The Federal Reserve is near the end of its tightening cycle.

The Federal Reserve has hiked rates by a cumulative 5.25% since the beginning of 2022 to combat inflation. At their December meeting, Fed Chairman Powell did not push back against the idea of rate cuts, as he has done in the past.

The Fed’s economic projections showed lower inflation forecasts for 2023, 2024 and 2025 without material revisions to the growth or employment forecasts. With these revisions, the Fed is acknowledging that inflation is falling faster than expected and labor market conditions are easing. In other words, the Fed is declaring victory and forecasting a “soft-landing” scenario.

The expected year-end federal funds rate is 4.6% for 2024, which implies three cuts this year. Based on interest rate futures, the bond market is expecting this to be closer to 3.5%.

The issue is clearly becoming the timing and extent of eventual rate cuts, and such a wide difference in expectations creates disjointedness in both stock and bond markets.

- Broadening U.S. equity market performance will create opportunities.

The outperformance in 2023 is owed to a combination of better-than-expected consumer spending, resilient corporate profits, and enthusiasm around the advancements in AI. However, as we mentioned, equity market performance was not broad-based.

The index concentration seen from the “Magnificent 7” is not a new phenomenon as the weight of the top 10 stocks in the S&P 500 have been rising since 2016. The earnings contribution from those stocks, however, hasn’t kept pace and hardly budged last year. The top 10 stocks make up a third of the index, but only account for a fifth of index earnings. This suggests significant mispricing in the stock market.

In 2024, if economic growth remains positive and technological advancements yield significant productivity gains, markets could still perform well. That said, gains should broaden out beyond the largest names. In environments like these, companies with sustainable, high-quality earnings that are being overlooked by the markets provide the best opportunity.

- While peak cash yields look attractive, holding too much cash can be costly.

Policy tightening from the Fed has pushed yields on cash-like investments to their most attractive levels in over a decade. With rates north of 5% and minimal risk, heavy cash allocations have been common.

However, history shows that staying parked in cash after the peak in interest rates usually leaves money on the table. In the last 6 rate hiking cycles, the U.S. Aggregate Bond Index outperformed cash over each of the 12-month periods following the peak in CD rates.

This is not to say that investors should abandon cash altogether, as liquidity is an important allocation in any portfolio. However, there is an opportunity cost in holding onto too much cash, and long-term money should be in long-term assets.

We hope you enjoyed our comments. If you have any questions, please do not hesitate to contact us. We welcome the opportunity to discuss our thoughts in greater detail. Thank you for your continued confidence in Planning Capital.

Sincerely,

The Planning Capital Team

Author

Daniel B. Brady, MBA, CFP® │ Partner

Contributors

Richard W. Bell, Jr., CKA® │ Partner

David A. Emery, MBA, CDFA®, CFP® │ Senior Financial Planner

Jay D. Ahlbeck, CLU®, ChFC® │ Senior Financial Planner

Paul C. McClatchy, MBA, CFP® │ Senior Financial Planner

[1] Cornerstone Portfolio Research, Monthly Market Analysis, January 2024

[2] Hardika Singh, “It’s the Magnificent Seven’s Market,” The Wall Street Journal, December 17, 2023

[3] Matthew Fox, “S&P 500 Record High Would Suggest Double-Digit Gains,” Markets Insider, January 8, 2024

[4] David Kelly, “Q1 2024 Guide to the Markets,” JP Morgan, January 2, 2024

[5] Henry McVey, “Glass Half Full,” KKR Outlook, January 2024

Want a chance to discuss this month’s Quarterly Commentary with Rick Bell and Dan Brady? Join us for the next Quarterly Conversation, our regular live webinar series on Zoom. The next one is coming up on January 18 at 4 pm. RSVP at the link.