How Much Does it Cost to Work with a Financial Advisor?

1/19/2021

Financial planning, investments, and money matters can be a complex subject for just about anyone. Between juggling all the apps available for budgeting and investing and navigating the boundless breadth of the tax code with your accountant, trying to figure out how all the different pieces fit into your overall life plan can be overwhelming.

That’s when the decision to work with a financial planner to do it all for you usually begins to take root. Then, just when you’re ready to make your life simpler, you’re faced with a new question: how much does working with a financial planner cost? And a few minutes of internet research tells you…there’s no simple answer.

Let us take the question on for you. In this article, we’ll comparatively examine how fee structures in the financial planning industry work, and then explain how ours at Planning Capital is different.

Fee structures vary from firm to firm and advisor to advisor, but here are the basics.

The flat annual fee.

The flat annual fee is one of the most common fee types you will come across when looking to work with a financial planner. As its name suggests, advisors using this fee structure will charge an upfront yearly rate, based on the quantity and complexity of services you need. This fee can fall anywhere from $2,000 to $7,000 a year.

Assets Under Management (AUM) or “Fee Based”

The AUM is another very common fee structure. This fee comes from a percentage of the total dollar amount of the assets that the firm manages on your behalf.

The industry average AUM fee is usually between 1 and 2%, it tends to be higher for small accounts (accounts with fewer assets) and lower for large accounts. So the good news is that with this fee type, as your account grows the percentage you are charged will likely go down.

While the AUM can be more expensive than the flat fee, it also means your advisor will be less likely to take risks with your portfolio, as their fee is directly impacted by your portfolio’s performance.

Hourly Rate

The hourly rate is essentially the ‘pay-as-you-go’ version of financial advising. You pay no percentage of assets, but might be charged anywhere from $200-$600 per hour for your advisor’s time. This leaves you with more control over the cost, but might limit the amount of services you receive as a result.

Commision-Based

When an advisory fee is commission-based, your advisor recommends investing in a particular stock or other investment, and then earns a commission from the trade. When working within this fee structure, just be sure to work with an advisor you trust to put your needs first, and who will be transparent about how he or she is being paid.

What Sets Planning Capital Apart

Planning Capital’s fee structure breaks with the traditional financial planning model in that it combines two of the above approaches: a flat annual rate and a percentage model or AUM.

Inspired by our client-first approach, our model gives us greater flexibility to work in-depth with a wide range of clients. While many advisors who operate solely on an AUM percentage model are limited to working with clients with high net worth and tangible assets, we can provide a full range of services just as easily to clients whose net worth is composed more heavily of unrealized assets like stock options, 401K plans, pension plans, business and real estate holdings.

Additionally, our fee structure gives us the freedom to maintain an open line of communication with our clients from day one, as we are unconstrained by hourly rates or limited service plans. Our focus can thus extend far beyond our clients’ assets, covering each of the details that make up their financial lives. Each step we take is therefore made with unbiased decision-making, thanks to this big picture view of our clients’ lives and needs.

While other advisors typically approach planning from one of two models – a goal setting model, which manages client assets with a specific financial goal in mind, like retirement or saving for college, or a cash-flow model, which aims to maximize available cash flow, Planning Capital utilizes both. Our combined fee structure leaves us free to ensure that our clients’ goals are met, while we can simultaneously watch that their cash flow keeps them financially secure.

Whether our clients come to us for Financial Planning, Portfolio Management or both, they benefit from the transparency of our fees and consistency of our approach.

If you’d like to know more about what Planning Capital’s cost might look like for you, the Fee Calculator on our website can give you a rough estimate of our flat annual fee. It’s based on a number of factors, such as what life stage you are in and what your specific financial needs are. The quiz is short and simple.

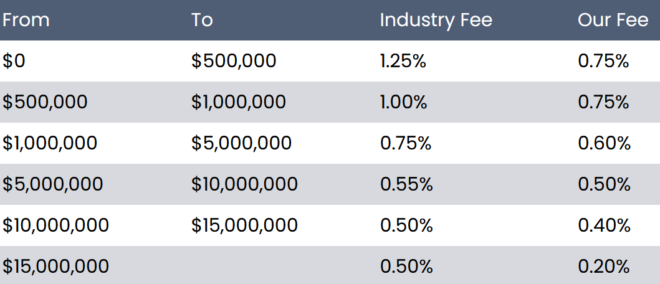

The other component of our fee structure, the percentage of AUM, typically falls below the industry average when combined with Financial Planning. We’ve laid out our percentage per total assets range in the chart for you below.

This unique combination of flat annual fee with percentage of AUM gives us the freedom to ensure our clients’ needs always come first. It also means we’ll be there with you, every step of the way, from creating your financial plan to helping you make it happen.

If this article leaves you with additional questions about fee structures or financial planning, we’re happy to answer them, any time:

info@planningcapital.com or https://planningcapital.com/schedule-a-call/.

Sources:

Jesse Neugarten, “What Fees do Financial Advisors Charge?”, Investopedia, January 10, 2020

Arielle O’Shea and Andrea Coombes, “How Much Does a Financial Advisor Cost?”, NerdWallet, October 20, 2020

Planning Capital Management Corp is a Registered Investment Advisor with the SEC, and we are held to a fiduciary standard with all of our clients. We offer full financial planning in conjunction with investment advice and portfolio management. Should you have any questions or concerns about current market conditions, or just general financial planning questions, you can reach us at: (215) 709-5100 or info@planningcapital.com.