Commentary – 2023 1st Quarter

1/12/2023

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

- Warren Buffet’s 1987 letter to Berkshire Hathaway shareholders

What a Difference a Day Makes

To say we are happy to have 2022 in the rearview mirror is an understatement. It was the worst year for the stock market since 2008, and the worst year for the bond market since reliable recordkeeping began in the 19th century[1].

By the second quarter, it was clear that stubbornly high inflation would force the Fed to raise its benchmark interest rate more aggressively than it was letting on. Also, inflated expectations for corporate earnings helped contribute to the pain as U.S. consumer spending waned.

While the market was open for 251 trading days last year, the storyline for 2022 was best encapsulated by five days which accounted for more than 95% of the S&P 500 losses[2]. Two were caused by unexpected inflation data, while the others were triggered by disappointing corporate earnings and commentary from Federal Reserve Chairman Jerome Powell.

Unfortunately, the turning of the calendar does not mean a turning of the tide. With the resolve to battle inflation amid a remarkably resilient labor market, the Fed’s crusade of raising interest rates will continue. The economic cycle is still in extra innings, meaning a recession is likely in on the horizon.

We expect a rocky start to 2023 through the first half of the year as markets continue to digest these issues. But optimistically, the Fed’s policies should start working as lagging inflation data comes to the surface, providing tailwinds for the second half of the year.

Be Careful What You Wish For

The market can behave like an (often irrational) electoral contest in the short term, determining a company’s share price based on how popular or unpopular it appears at the time. When markets behave in this fashion, they tend to ignore underlying fundamentals and are driven by speculation and sentiment. This, Warren Buffet claimed in 1987, was like a voting machine.

Recently, we’ve seen both sides of this coin during Covid-19, the subsequent “everything rally” of 2020-2021, and the 2022 bear market.

Buffett believed that in the long run, however, the market acts as a weighing machine. Equity prices eventually reflect the fundamental characteristics of a business, including a company’s earnings growth potential, financial strength, competitive advantages, and management quality.

In recent years, and for the foreseeable future, the market is laser-focused on one thing which has nothing to do with fundamentals and everything to do with speculation: the Federal Reserve. More specifically, there is an obsession with interest rate policy and when the “Fed pivot,” a turn from interest rate increases to decreases, will occur.

This is not to downplay the significance of Federal Reserve policy as it pertains to the financial markets. As we have mentioned in past, the correlation between the Fed’s balance sheet and the S&P 500 has been striking since quantitative easing (the modern monetary tool) began after the 2008 crisis.

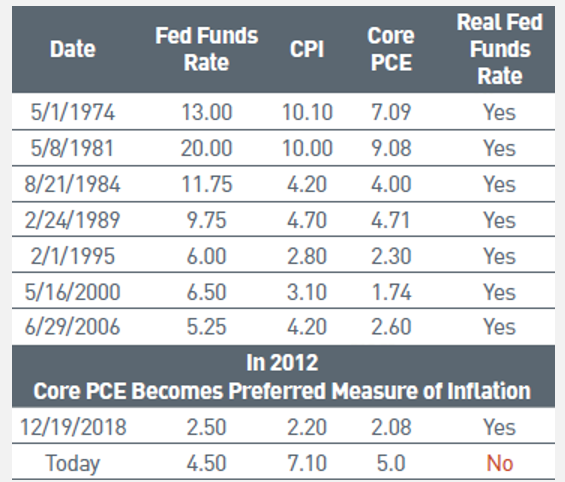

Furthermore, as inflation continues its descent, there is historical precedent that the Federal Reserve will pivot (see: Figure 1). During each of the last eight rate hike cycles going back to the 1970s, the “real” rate (i.e., the federal funds rate less inflation) was positive before interest rate increases were paused[3].

Today, the federal funds rate sits at 4.5% with planned increases of 0.75% (three more hikes) in the first half of 2023[4]. With core inflation at 5% and falling, this should give the Federal Reserve enough confidence to pause.

Not so fast, says the Fed.

A line from the minutes of the central bank’s December policy meeting issued a warning to financial markets that bets on a policy pivot in 2023 aren’t welcome. And, to the extent that equity rallies and other financial market developments loosen overall financial conditions, those wagers will only force the Fed’s policy-setting Federal Open Market Committee to prolong the pain necessary to bring down inflation. Here’s the quote from Jerome Powell –

“Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee’s reaction function, would complicate the Committee’s effort to restore price stability.”

Translated, this means that the Fed does not like stock market rallies, as they fear it could result in potentially inflationary consumer spending. It would stand to reason that if equities continue to rally on bad economic news, that the Fed will need to push forward to an even higher terminal rate and unofficially add ‘market correction’ to their mandate.

With a strong labor market holding up an economy begging for a recession, the Fed may need to keep rates higher for longer. None of the Federal Reserve board members are anticipating a rate cut in 2023. And, while the jury is out on the direction beyond 2023, the consensus does appear to be that rates will eventually decrease in 2024 or 2025.

While the bulls continue to “cast their votes” that the Federal Reserve will lose its nerve, a moment of reckoning is long overdue. Memories of the swift, Fed-induced pandemic recovery are dominating the thinking of today’s investors, many of whom are so conditioned to the success of dip-buying that they’re ignoring a shaky foundation in equities.

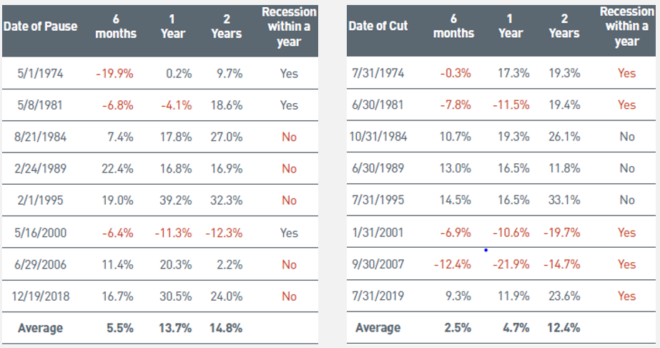

As much as investors cheer the Fed pivot, by the time rates come down the economy is usually too beat-up for stocks to go anywhere. The realities of decreased earnings guidance, higher costs of capital, and softening demand are likely to end up squashing any rally in equities. To wit, the only times when markets struggled after a Fed pause or pivot were during recessionary periods (see: Figure 2).

As predicted by various economists and researchers, we have seen the probability of a U.S. recession in 2023 range from 50-75% making the ‘go to cash’ strategy seem tempting. But we firmly believe one of the most important decisions for investors during these volatile rate hike periods is to remain invested.

Markets price in better days ahead. And, if you are not invested at the turn, the train may leave the station without you. Case and point: the unemployment rate historically peaks 6 months after the stock market bottom[5]. This has been true during the last 9 recessions.

In other words, if you did not put your cash back to work (assuming you used the aforementioned ‘go to cash’ strategy) at the precisely correct time, in the middle of a recession, a tremendous amount of upside was missed. This not only requires skill (read: luck), but an extraordinary amount of conviction.

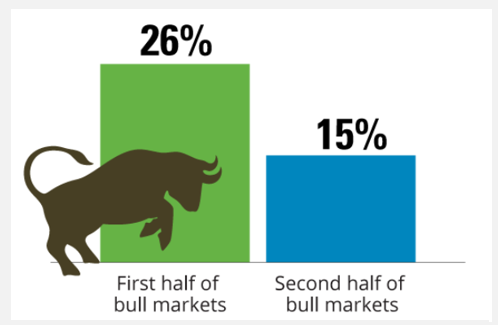

The same phenomenon is also true of the broader market cycle—bull markets tend to be front-loaded. During the last 10 bull markets, almost double the amount of investment returns came from the first half versus the second half of the bull market (see: Figure 3)[6].

While we remain optimistic that the imminent recession will be mild, there does not appear to be a catalyst for an aggressive bounce back. And with the Fed’s newfound vigor for squashing market rallies, we expect to see short-term volatility as the voting machine works at odds with the powers-that-be.

Long-term, the weighing machine will be grappling with a new market cycle that looks nothing like the last one. A return to the near-zero interest rates of the past 15 years is incredibly unlikely. Elevated inflation should also continue as a large factor of the economic reality moving forward. Among other factors, these tell us that there is slow growth on the horizon. We are not holding our breath for the S&P 500 to get back to its previous high.

Oh, By the Way

Amidst the onslaught of “recession watch” coverage, monumental retirement legislation was passed at the eleventh hour as part of the Consolidated Appropriations Act of 2023. Dubbed the Secure Act 2.0, it is the most substantial change to retirement planning since at least 2006.

There are a bevy of changes, but we have tried to distill it down to what we believe will be most relevant to our clients. So, here they are, the new retirement planning rules –

|

Effective 2023 |

Effective 2024 |

Effective 2025 |

Effective 2033 |

|

The new RMD age is 73 Employees can elect that the employer contribution to their 401(k) be Roth Up to $50,000 of IRA funds can be distributed to a charitable trust IRA beneficiaries can elect to be treated as the decedent for RMD purposes |

If wages are over $145,000, retirement catch-up contributions must be Roth Employer can make matching retirement contribution for student loan payments Excess 529 plan funds can be transferred into a Roth IRA, tax-free, up to $35,000 |

Retirement catch-up contribution limits will be 50% higher for those over 60 years old All 401(k) plans must have automatic enrollment |

The new RMD age is 75 |

There were two notable omissions from the bill that many experts had anticipated would be included –

- Inherited IRA rules have not changed. If you inherited an IRA as a non-spouse beneficiary after 2020, you must take distribution within 10 years (with no annual requirement).

- The backdoor Roth strategy is still alive. This “loophole” allows high-income earners who are phased out of Roth contributions to use an IRA to pass-through these contributions.

We hope you enjoyed our comments. If you have any questions, please do not hesitate to contact us. We welcome the opportunity to discuss our thoughts in greater detail. Thank you for your continued confidence in Planning Capital.

Sincerely,

The Planning Capital Team

Author

Daniel B. Brady, MBA, CFP® │ Partner

Contributors

Richard W. Bell, Jr., CKA® │ Partner

David A. Emery, MBA, CDFA®, CFP® │ Senior Financial Planner

Jay D. Ahlbeck, CLU®, ChFC® │ Senior Financial Planner

Paul C. McClatchy, MBA, CFP® │ Senior Financial Planner

[1] Jason Zweig, “It’s the Worst Bond Market Since 1842,” The Wall Street Journal, May 6, 2022

[2] Joseph Adinolfi, “Five Days That Killed the Year,” Barron’s, December 28, 2022

[3] Investor’s Field Guide to 2023, PNC Financial Services Group

[4] Q1 2023 Guide to the Markets, JP Morgan

[5] Q1 2023 Guide to the Markets, JP Morgan

[6] Robert Laura, “Clients Don’t Want to Hear, “It’s Gonna Be OK,” Hartford Funds, December 27, 2022