Investing for the Long Haul

6/26/2015

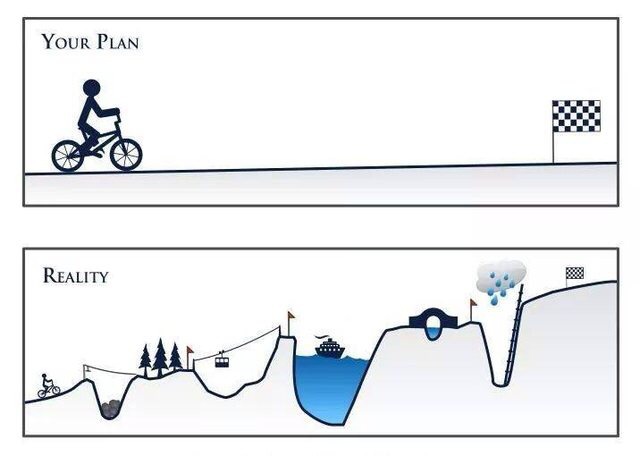

Investing for the long haul is a passive investment approach. Sometimes called a buy-and-hold or value strategy, the long-term investor will not make sudden portfolio moves based on short-term market fluctuations

You may miss out on extreme gains by investing for the long haul, but you’ll also miss extreme losses, which will give you invaluable security and peace of mind. In fact, a 20-year holding period has never delivered a loss on stocks throughout history.

Bad Markets

The typical investor is tempted to get out of a bad market by selling. This emotionally driven response can be catastrophic to portfolio performance and recovery. The economy fluctuates between good and bad all the time, and those who constantly buy and sell will be hit the hardest in a bad economy. While broad trends should be considered, the long-term approach does not try to time the market. By holding on to your investments, you’ll be better able to ride out an economic downturn, especially if your portfolio is diversified. Short-term fluctuations don’t matter as much.

Cultivating Your Portfolio

The term “buy and hold” doesn’t mean investing and forgetting about it for the next 20 years. There are ways to cultivate and prune your portfolio while still maintaining your long-haul investing strategy. For instance, if a company you invest in changes fundamentally, you may not want to continue investing in them. If the market changes dramatically, as it has in the past, you may actually benefit from selling. Finally, your changing goals as you get closer to retirement may warrant a more conservative portfolio. Having a plan for cultivating your portfolio protects you from reacting emotionally to short-term market fluctuations.

Short-term Investing

If you do implement a short-term investing strategy, make sure the amount you invest is the amount you’re willing to lose. Short-term investments see the most volatility, which makes this strategy too risky for the majority of investors. Often the majority of a year’s gains are seen in a short period of a few days, so those who practice short-term investing may miss out on those gains, where long-term investors are sure to be invested in the market at that time. To safely make money in the stock market, long-haul investing is the way to go.

Taxes

Short-term gains are taxed at a higher rate than long-term gains. Even if you have the fortune of timing the market successfully, your profits can be disproportionately diminished by taxes if the investment is held for less than a year. Short-term strategies are normally focused on investment return, many times ignoring tax impact. A good long-term approach should consider all angles, including taxes, not only from a current but also from a future standpoint.