Commentary – 2022 2nd Quarter

4/21/2022

“Boy, there’s nothing worse than an inscrutable omen.”

- Bill Watterson

Beware the Ides of April

Another quarter, another set of record inflation data for the U.S. –

- The Consumer Price Index accelerated to 8.5% in March, a four-decade high.

- The Producer Price Index rose 11.2% year-over-year in March, the highest increase since 2010.

- Consumers expect inflation will hit 6.6% in March 2023, up from the 6% they had predicted in February. That was the highest reading in a survey that goes back to 2013, according to the Federal Reserve Bank of New York.

Monetary policy concerns are dominating the inflation conversation. The Federal Reserve is projecting 7 interest rate hikes of 0.25% and the futures market is predicting 8 rate hikes. The interest rates on 30-year mortgages have skyrocketed to over 5%, coming off historic lows near 2% not one-year ago.

The continued move higher in interest rates has had a devastating effect on bonds. This is now the longest U.S. bond market drawdown in history (20 months and counting) and the largest (-7.6%) since 1981[1]. After the strong rally in equities and poor returns from bonds in 2021, the first quarter of 2022 was quite difficult.

In 1981, the 10-year yield was at 15.8% and the bond market hit a new high just 2 months after bottoming. Today the 10-year is at 2.7%, and likely to take much longer to recover.

Focus quickly shifted, however, when Russia invaded Ukraine. This led to an initial flight to safety (bonds and gold) and higher oil prices, soon followed by a re-selloff of bonds amid even greater inflation fears due to soaring commodity prices and significant supply chain concerns.

Counterintuitively, there are still many reasons to be optimistic about the economy. While the business cycle is reaching a more mature phase, there is good reason to believe that expansion can continue even with the geopolitical risk and policy concerns.

The Bull Case

- Covid impacts on the U.S. economy are diminishing quickly. Most experts expect a return to trend growth as if Covid never occurred. Hotel, restaurant, and travel spending as a percentage of GDP are returning to pre-Covid levels.

- Russia-Ukraine impact on the U.S. is much smaller than overseas, as dependence on foreign oil and spending on energy is much less than it used to be.

- Earnings will be the driver of growth and are showing some promising signs for US equities.

- Housing starts (often a sign of a healthy economy) have reached their highest level in over 15 years.

The Bear Case

- Inflation appears to be entrenched across the globe.

- Unemployment at 3.6% and wages up 6.7%, typically unemployment rate will need to rise before wage growth slows (11 million job openings and 6 million unemployed workers is a record high disparity)

- “Sticky” inflation is increasing (See: Figure 1).

- Russia-Ukraine conflict poses significant shortages as planting season is around the corner, extending pressure on oil prices.

- China is experiencing Covid spikes, which is likely to prolong supply chain issues.

- A monetary and fiscal “cliff” looms large.

- There will be a dramatic decline in the Federal Reserve balance sheet (tightening).

- There is a 91% correlation between the Federal Reserve balance sheet and the S&P 500.

- Pandemic stimulus has run out.

It is difficult to know which thread to follow, but the bottom line is that the U.S. is staring down the barrel of an overheating economy with rising inflation. Unfortunately, history suggests the Fed will have a difficult time achieving a soft landing.

During the past 80 years, the Fed has never lowered inflation as much as it is setting out to do now—by 4 percentage points—without causing recession[2]. In this case, the central bank will need several factors out of its control to break its way. As they say in golf, it may be better to be lucky than good in this case.

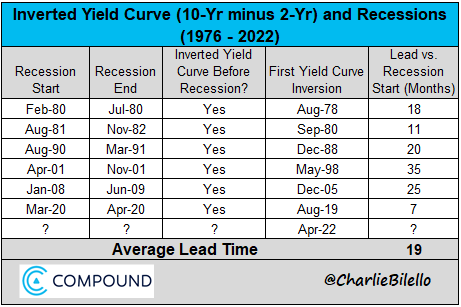

Furthermore, the dreaded yield curve inversion has once again reared its ugly head. Officially measured by the yield on a 2-year Treasury versus a 10-year Treasury, an inversion occurs when the shorter term has a higher yield. This tends to be a pretty good indicator of future economic weakness. Case in point: the last 6 recessions in the U.S. were all preceded by an inverted curve (See: Figure 2).

So, the question is less whether a recession is coming (a recession is always coming at some point in the future), but when is a recession coming?

If we take this chart as a guide, a recession could be coming anywhere between 7 and 35 months from when the yield curve inverted (this month). This suggests a recession will come anywhere between November of this year and March 2025. It is not exactly a precise indicator.

The lack of precision is where things get much more complicated. Stocks tend to “top out” much closer to the start of recessions and the stock market is not the economy. In fact, the stock market typically rises after the yield curve inverts. Following the last six inversions, the S&P 500 went on to gain an average of 27% (between 9% and 52%) before hitting a top[3].

There is no “holy grail” indicator that can predict exactly when a recession will occur, how long it will last, and how deep it will be. Even if there was such an indicator, it would be impossible to use it in timing stock market exposure. However, the yield curve has quite a long track record as a leading economic indicator. The recent inversion simply means that investors are anticipating a slowdown in economic growth at some point soon.

For what it’s worth, most experts we respect are putting the risk of a recession relatively low over the next 12 months due to momentum from re-opening the economy post-Covid. Beyond the next 12 months, we have heard ranging estimates of a 25-50% chance of recession in 2023 or 2024.

Let’s be sure to distinguish stock market corrections and economic recessions. Ten to fifteen percent stock corrections are commonplace and, in most cases, they are buying opportunities. Recessions are marked by 35% corrections that last 18-24 months. These markets typically have multiple head fakes that suck in investors before making new lows. At the end of a recession, investors become exhausted and mass selling happens at the bottom.

2010-2020 was the first decade without a recession since 1850[4]. The Covid crisis was a 30-day bear market, so, albeit not imminent, a true American recession is likely on the horizon. Even if this is the case, it is impossible to predict:

- Precisely when the recession will happen.

- If/when the stock market will begin to fall.

- The magnitude of the recession and stock market correction.

- What the Fed will do in the meantime.

The Fed has an incredible task, but we have been through these situations in history and the U.S. always comes out on top. The best investing days are always ahead.

Greatly Reduced Expectations

After pondering the bull case and bear case, dissecting market omens, and reiterating the importance of staying invested, one wonders—how are we feeling about the market?

Alas, inflation has much to do with whether Americans believe in inflation. The stock market has similar undertones. The American Association of Individual Investors’ weekly sentiment survey has been carried out for decades. Retail investors are simply asked if they’re feeling bullish, bearish, or neither. This week, fewer called themselves bullish than in any week since September 1992[5]

In other words, investors were more optimistic after 9/11, during the Covid lockdown, and during the Global Financial Crisis, than they are now.

It may not be time to sound the alarm bells, as a more complete measure looks far more nuanced. Many investors are noncommittal (i.e., answering “neither”) on the questionnaire and the proportion calling themselves “bearish” is still under 50%.

This appears to be a shared viewpoint, as almost all major research groups are predicting that it will be much more difficult to make money across all corners of the market (See: Figure 3).

Higher interest rates and inflation will not only effect bond returns going forward, but every asset class available. Returns in the stock market are likely to revert to the mean instead of the high double digits during the past decade. The era of low inflation driven by technology and relocation of workers to low wage countries looks to be ending.

Perhaps the most notable area of change appears in Vanguard’s projection for U.S. growth stocks—they see essentially flat returns over the next decade.

|

Equities |

Fixed income |

|

|

|

U.S. equities |

2.0%–4.0% |

U.S. aggregate bonds |

1.5%–2.5% |

|

U.S. value |

2.8%–4.8% |

U.S. Treasury bonds |

1.2%–2.2% |

|

U.S. growth |

–1.2%–0.8% |

U.S. credit bonds |

1.8%–2.8% |

|

U.S. large-cap |

1.9%–3.9% |

U.S. high-yield corporate bonds |

2.3%–3.3% |

|

U.S. small-cap |

2.3%–4.3% |

U.S. Treasury Inflation-Protected |

1.2%–2.2% |

|

U.S. real estate trusts |

1.8%–3.8% |

U.S. cash |

1.2%–2.2% |

|

Global ex-U.S. |

5.1%–7.1% |

Global bonds ex-U.S. |

1.3%–2.3% |

|

Emerging markets |

4.3%–6.3% |

Emerging markets |

2.5%–3.5% |

|

|

|

|

|

|

U.S. inflation |

1.6%–2.6% |

|

|

|

Figure 3: Vanguard Capital Markets 10-year nominal return projections as of December 31,2021 |

|||

The bottom line is that we are witnessing a huge rotation away from technology and growth towards inflation-friendly sectors such as commodities and value stocks. This is likely to be a pervasive investment theme for years to come.

The stock and bond markets already experienced a traditional non-recessionary correction in the first quarter 2022. The next negative event will likely be a recession but, as we described, predicting the timing is not easy. Right now, diversifying beyond the traditional 60/40 portfolio is imperative as heavier weightings towards short-term bonds and dividend-paying stocks should be implemented.

Furthermore, increased volatility renews the case for aggressive dollar cost averaging, inflation hedging, and putting any cash to work during stock downturns.

There is still opportunity for investments focusing on safety of principal and reasonable rates of return.

We hope you enjoyed our comments. If you have any questions, please do not hesitate to contact us. Thank you for your continued confidence in Planning Capital.

Sincerely,

The Planning Capital Team

Author

Daniel B. Brady, MBA, CFP® │ Partner

Contributors

Richard W. Bell, Jr., CKA® │ Partner

David A. Emery, MBA, CFP® │ Senior Financial Planner

Jay D. Ahlbeck, CLU®, ChFC® │ Senior Financial Planner

Paul C. McClatchy, MBA, CFP® │ Senior Financial Planner

[1] Matt Topley, “Topley’s Top 10,” April 15, 2022

[2] John Hilsenrath, “Hot Economy, Rising Inflation,” The Wall Street Journal, April 18, 2022

[3] Charlie Bilello, “The Inverted Yield Curve Omen,” Compound Capital Advisors, April 14, 2022

[4] Matt Topley, “Fed Ends Sugar Mountain,” Lansing Street Advisors, April 5, 2022

[5] John Authers, “The Bulls Go Out to Pasture,” Bloomberg Points of Return, April 21, 2022