Commentary – 2022 4th Quarter

10/21/2022

“It’s not about timing the market, it’s about time in the market.”

- Warren Buffett

All Bite, No Bark

The U.S. economy is teetering on the edge of a recession that has been delayed and potentially softened by excess labor demand, the lack of over-building in the most cyclical sectors of the economy, and healthy bank balance sheets. But it could be a recession that lingers, as mortgage rates double and the dollar is almost at a four-decade high, while high income inequality and weak demographics combine to potentially hamper a recovery.

David Kelly, JP Morgan’s chief global economist, perhaps summed this up best[1]:

“With only a moderate rise in unemployment and no overwhelming shock, unlike the Great Financial Crisis more than a decade ago and the coronavirus-sparked pandemic recession, this could be the recession that didn’t bark.”

This is a reference to Sir Arthur Conan Doyle’s “The Adventure of Silver Blaze.” The mystery chronicles Sherlock Holmes’ investigation into the disappearance of Silver Blaze, a great racehorse. Holmes found it peculiar that a guard dog didn’t bark during the night of the incident. He concluded that this meant the perpetrator could not have been a stranger.

This is a great analogy. First, it is unlikely that the federal government or the Federal Reserve will react quickly to combat the downturn (i.e., they won’t “bark”). Second, it is highly likely that recession will be brought on due to the aggressively contractionary policies being implemented now. The Federal Reserve can’t say it because of their mandate, but a rise in unemployment would help their cause—a recession is almost a necessity in their crusade against inflation (i.e., they aren’t “strangers”).

Unfortunately, last month’s hotter than expected inflation report further emboldened an already hawkish Federal Reserve. Interest rates were once again hiked by 0.75%. Investors had hoped easing prices, particularly for gas, coupled with evidence of slowing economic growth might persuade the Fed to enact moderate rate increases during the remainder of the year—an unlikely prospect at this point.

While precise details regarding future hikes have not been articulated, rates will likely increase an additional 1% to 1.25% by the end of the year. The year-end Fed Funds rate is expected to reach the 4.25% to 4.50% range. 12 out of 19 Federal Reserve board members expect this to be between 4.5% and 5.0% by the end of 2023. This is an historically aggressive rate hike schedule, coming off near-zero rates only one year ago.

The last time the Fed hiked interest rates at this pace was to fight the inflation of the 1980s. While 30-year mortgage rates have yet to hit double-digits, they recently bounced off 7%. Even so, the housing market appears remarkably resilient (more on that later), giving the Federal Reserve further reason to keep rates elevated for longer. At a recent press conference, Jerome Powell emphasized that a policy-induced recession is likely the price to be paid to combat inflationary pressures. He also indicated that slowing economic growth, a balanced labor market, and inflation approaching 2% are all necessary before the Fed will consider halting rate hikes.

Although President Biden contradicted this sentiment, stating that a recession in the U.S. is unlikely, independent researchers say otherwise. The U.S. economy falling into recession within the next 12 months is a virtual certainty, according to the latest Bloomberg Economics forecast model released on Monday, showing a 100% probability. A separate Bloomberg survey of 42 economists predicts the probability of a recession over the next 12 months at 60%, up from 50% a month earlier[2].

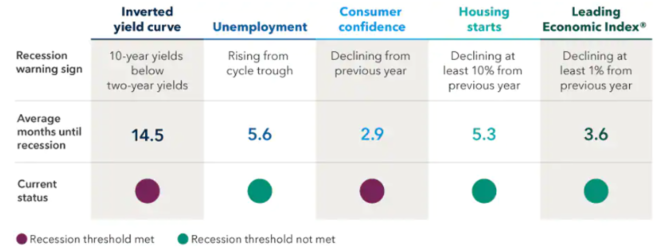

Markets appear convinced as well, with money pouring into short-term Treasuries. 12-month notes are now yielding over 4.5% and have inverted the rest of the curve for several months—a typical recession indicator (See: Figure 1).

Figure 1: Recession Indicators

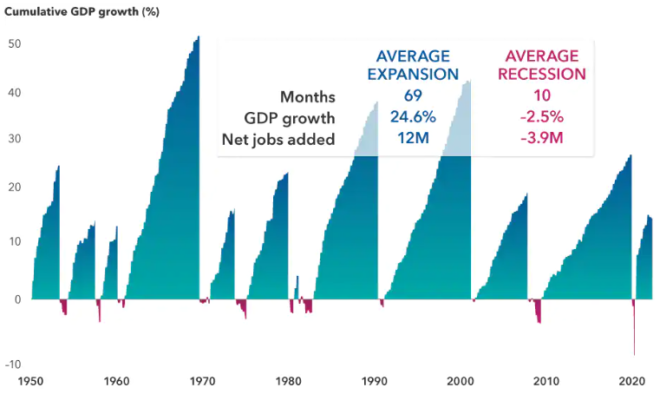

Historically, recessions generally haven’t lasted very long. Out of 11 cycles since 1950, recessions have persisted between two and 18 months, with the average spanning about 10 months (See: Figure 2). For those directly affected by job loss or business closures, that can feel like an eternity. But investors with a long-term investment horizon would be better served looking at the full picture—these are relatively small blips in economic history.

Over the last 70 years, the U.S. has been in an official recession less than 15% of all months. Moreover, their net economic impact has been relatively small. The average expansion increased economic output by almost 25%, whereas the average recession reduced GDP by 2.5%. Equity returns can even be positive over the full length of a contraction since some of the strongest stock rallies have occurred during the late stages of a recession.

The exact timing of a recession is hard to predict. Officially, they are only defined posthumously by the National Bureau of Economic Research. Bear markets (market declines of 20% or more) and recessions have often overlapped. Stocks typically lead the economic cycle by six to seven months on the way down and again on the way up[3].

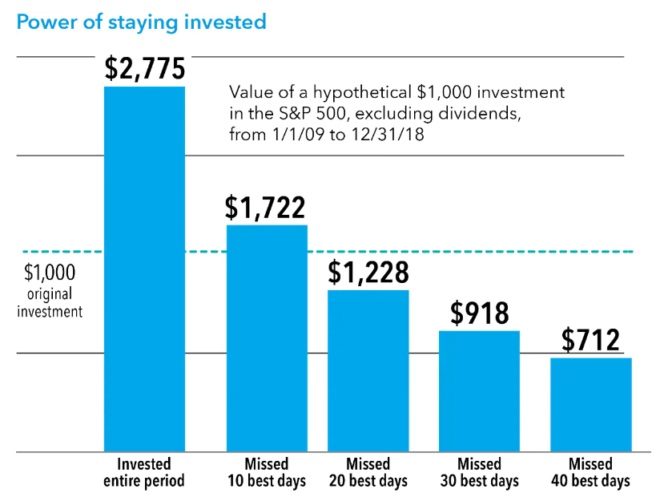

Still, aggressive market-timing moves, such as shifting an entire portfolio into cash, can backfire. Some of the strongest returns can occur during the late stages of an economic cycle or immediately after a market bottom.

Serenity Now

2022 has been a particularly difficult year for three major reasons:

- The frequency of intraday swings of 1% or more for the S&P 500 has been “extremely elevated” in 2022. More than 87% of trading days so far in 2022 have experienced swings that big. The last time the market had intraday volatility this often was in 2008 during the global financial crisis[4].

- It has been the most devastating period for bonds since at least 1926 and is shaping up to be the worst bond year since reliable record-keeping began in the late 18th century[5].

- Since peaking at 9.1% year-over-year in June, inflation readings have improved—down to 8.2% in August. But the Atlanta Fed’s sticky inflation measure (removing the volatile components) rose to 6.1% year-over-year, a new high[6].

Not to mention the S&P 500 is in a bear market, correcting over 20% from the high and staying there. Simply put, there is nowhere to hide. Both stock and bond markets have all but priced in a recession, as well as the planned interest rate hikes.

Underneath the hood, there have been very encouraging decreases in inflation data, especially in service sectors. But the headline consumer price index data for September (used by the Federal Reserve and the government) showed that housing costs for both renters and homeowners continue to soar. Various private-sector data, however, show that rent costs have plateaued and are starting to fall, while home prices are decelerating at their fastest pace on record[7].

The main reason for the gap in data is that the government is measuring rental costs based on all leases, while private firms, such as Zillow, only look at new leases. That makes the private data more of a leading indicator than the public data, which tends to lag by about 12 months.

Housing makes up a huge chunk of the official consumer price index, approximately 30%. This could keep inflation statistics elevated for months, even as prices soften, and may keep the Federal Reserve on its inflation warpath for longer than necessary.

Given this backdrop, David Kelly expanded on his post-recession outlook:

“Growth could remain anemic, and inflation could drift below 2%. This could lead the federal funds rate to drop and set up a period of slow growth, low inflation, low interest rates, and high profit margins. Such an environment would be very unsatisfying for those looking for an improvement in living standards after years of inflation followed by stagnation. However, it would provide strong support for today’s beaten down bond and stock markets.”

In other words, much of the pain may be in the rearview mirror, at least from an investment perspective. That’s the good news. The bad news is that there does not appear to be a catalyst for a “snap back” in the market.

Furthermore, there is good reason to believe that volatility will remain elevated in 2023.

Given these conditions, Planning Capital recommends that investors stay disciplined. The Fed will stop raising rates at some point. In January 2019, the Fed announced it was pausing its then current hiking cycle, and markets rebounded. These announcements can come at unexpected times, and it is imperative to remain invested to catch the wave on the way back up.

However, it can be hard to do nothing when markets are rough. Here are some things to consider:

- Bear markets don’t last. The Schwab Center for Financial Research looked at both bull and bear markets for the S&P 500 going back to the late ’60s and found that the average bull ran for about six years, delivering an average cumulative return of over 200%. The average bear market lasted roughly 15 months, delivering an average cumulative loss of 38.4%. The longest of the bears was just over two and a half years—and was followed by a nearly five-year bull run. The shortest was the pandemic-fueled bear market in early 2020, which lasted a mere 33 days.

- Resist the urge to sell unless your financial situation warrants it. It’s difficult to time a perfect re-entry into the market. Market rebounds tend to be front-loaded. Missing those key days can significantly impact performance (See: Figure 3). Moreover, a diversified portfolio can help reduce the pain of volatility.

- Don’t try to time the markets. It’s nearly impossible. Time in the market is what matters. While staying the course and continuing to invest even when markets dip may be hard on your nerves, it can be healthier for your portfolio and can result in greater accumulated wealth over time.

- Take the good with the bad—tax loss harvesting in non-retirement accounts by utilizing tax swaps for holdings at a loss.

- Treasury I-Bonds still pay better interest rates than most savings accounts and CDs. Consider purchasing these with cash on hand.

We hope you enjoyed our comments. If you have any questions, please do not hesitate to contact us. We welcome the opportunity to discuss our thoughts in greater detail. Thank you for your continued confidence in Planning Capital.

Sincerely,

The Planning Capital Team

Author

Daniel B. Brady, MBA, CFP® │ Partner

Contributors

Richard W. Bell, Jr., CKA® │ Partner

David A. Emery, MBA, CDFA®, CFP® │ Senior Financial Planner

Jay D. Ahlbeck, CLU®, ChFC® │ Senior Financial Planner

Paul C. McClatchy, MBA, CFP® │ Senior Financial Planner

[1] David Kelly, JPMorgan, https://www.linkedin.com/pulse/recession-didnt-bark-david-kelly/

[2] Thomas Barrabi, Morningstar News – MarketWatch, https://www.morningstar.com/news/marketwatch/20221018181/100-probability-of-us-recession-in-coming-year-according-to-bloomberg-economics-forecast-model

[3] Jared Franz, Capital Group, https://www.capitalgroup.com/ria/insights/articles/guide-to-recessions.html

[4] George Smith, LPL Research, https://lplresearch.com/2022/09/01/is-2022-one-of-the-most-volatile-years-ever-for-stocks/

[5] Jeff Sommer, NYTimes, https://www.nytimes.com/2022/09/30/business/bonds-market.html

[6] Bill Stone, Forbes, https://www.forbes.com/sites/bill_stone/2022/09/18/persistent-inflation-send-stocks-near-bear-market-levels/

[7] Megan Cassella, Barron’s, https://www.barrons.com/articles/housing-rent-inflation-fed-problems-51666215832